|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding FHA Streamline Refinance Cash Out OptionsThe FHA Streamline Refinance is a popular option for homeowners looking to refinance their mortgages. While it offers several benefits, many homeowners wonder about the possibility of cashing out with this program. Let's explore what you need to know about FHA streamline refinance cash out. What is FHA Streamline Refinance?The FHA Streamline Refinance program is designed to help homeowners with existing FHA loans reduce their monthly payments and lower interest rates. It is one of the simplest and most efficient ways to refinance a mortgage, with minimal paperwork and no requirement for a home appraisal. Does FHA Streamline Refinance Allow Cash Out?Unlike traditional refinancing options, the FHA Streamline Refinance does not allow homeowners to take cash out. Its primary purpose is to provide a quick and easy way to refinance to a lower interest rate or a different term. Alternative Options for Cash Out

For those interested in exploring refinancing further, you might want to calculate your potential savings using a mortgage calculator oregon. Benefits of FHA Streamline RefinanceWhile it doesn't allow cash out, the FHA Streamline Refinance still offers numerous benefits:

Eligibility RequirementsTo qualify for an FHA Streamline Refinance, homeowners must meet specific criteria:

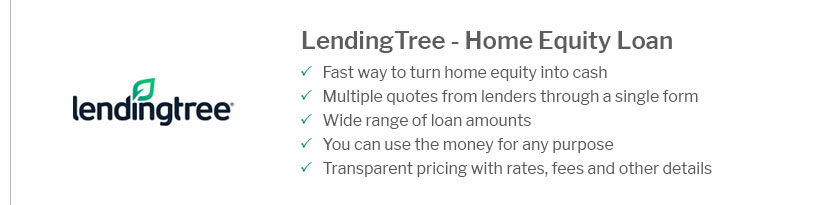

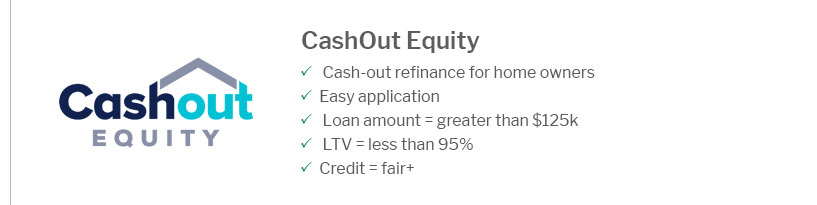

Additional ConsiderationsHomeowners should carefully consider their financial goals and consult with a mortgage professional to determine the best refinancing option. If cashing out is a priority, exploring other options like the FHA Cash-Out Refinance may be more suitable. Frequently Asked QuestionsCan I get cash back with an FHA Streamline Refinance?No, the FHA Streamline Refinance does not allow for cash back. Its focus is on reducing interest rates and monthly payments without cashing out. What are the advantages of FHA Streamline Refinance?The main advantages include no need for a home appraisal, reduced documentation, and potentially lower interest rates and monthly payments. What if I want to cash out my home equity?If cashing out is your goal, consider an FHA Cash-Out Refinance or a Home Equity Line of Credit (HELOC). These options allow you to access your home's equity. For more personalized refinancing calculations, you can also check a mortgage calculator tn for detailed insights. https://www.fha.com/fha_article?id=3008

FHA Streamline Refinance loans allow EEM funds for approved energy-saving improvements, and like the Cash-Out refinance loan rules mentioned above, these funds ... https://stockton.com/funding/wp-content/uploads/sites/2/2022/02/FHA-Refinance-2.7.22.pdf

The borrower must have made the payments for all mortgages secured by the subject property for the month prior to mortgage disbursement. Streamline Refinance ... https://www.quickenloans.com/learn/fha-cash-out-refinance

An FHA cash-out refinance is a type of refinancing that allows borrowers to replace their existing mortgage with a new FHA loan of a larger loan amount.

|

|---|